|

|||

| November 2012 | |||

|

|

The Years of Euphoria

In November 2009 the centre left party PASOK, having arrived in power, was astonished to discover the disastrous state of the finances left by the scandal-ridden New Democracy government. The deficit wasn’t around 6% of the GNP as the previous government had led them to believe, but around 12.7%! With a debt of 129% of the GNP, PASOK and with it the financial markets, that is to say the European and United banks, the insurance companies, the hedge Funds and so on, found they had a virtually bankrupt State on their hands. Naturally the latter proved reluctant to lend out any more money, even in the short term, despite Greece being in the European Union. The rates of interest started to rise, eventually exceeding 7% per annum!

Papandreu then called on his “European brothers” for help, and on the representatives of the French and German bourgeoisie in particular. Chancellor Merkel responded with a resounding ‘Nein’. And yet between 2000 and 2007 the French, German and U.S. banks had been clambering over each other to buy Greek government bonds and lend out money to the Greek private sector. These were the years of euphoria after the international crisis of 2001-2002 which, amongst other things, had seen the bankruptcy of the Argentine State and the consequent imposition on its creditors of a restructuring of the debt which included a hefty discount of 66%, hitting thousands of small “savers” especially hard.

The years 2002 -2007 were not great for European and North American industry. Average annual growth was around 1% in the United States, 0.5% in France and 0.47% in Japan. As regards England and Italy’s growth, or rather shrinkage, it was -0.6% and -0.2% respectively. Only Germany did somewhat better at 2.3%.

Given this situation our capitalists have thrown themselves wholeheartedly into the practice of relocating to Asia, and to China in particular, and sub-contracting work to companies there, in order to lower the costs of production (which allows companies like Apple, which no longer produce anything directly, to achieve fabulous profits of up to 40%). They also indulge in frenetic speculation of every kind, whether on raw materials (oil, metals, agricultural products…), property (typical of every crisis), or on loans. Ever more complex and sophisticated financial “products” have been invented, like the famous sub-prime mortgages. Questions about the exact nature of the investment are no longer that important, the main thing is to lend the money out! Everything is fine as long as it is “invested”, never mind the risk. But such speculations, despite what the bourgeoisie would have us believe, don’t actually create any wealth; it’s a con in which wealth is transferred from one pocket to another. Speculation rests on the same principles as the mafia rackets. The latter use force to extract wealth from people by force, whereas speculators use the power of finance capital and the protection of the State to fleece the general population.

In this connection it is interesting to read what Chancellor Merkel has to say about sub-prime mortgages:

«We think the securitization operations that have developed in a very dynamic way over recent years have certainly contributed to the financing of the development of our economies but, at the same time, they have shifted banking risks onto many in the business sector. One notes, however, that the end holders of such risks are not today easily identifiable and that this ignorance is, in itself, a factor of instability» (Les Échos, 20 August 2007).What this representative of the German big bourgeoisie calls “financing of the development of our economies” is nothing other than a further development of parasitism, expressing the highly parasitic character and advanced state of putrefaction in which contemporary capitalism finds itself in its imperialist phase.

But to go back to Greece, those capable of reading the signs could see the Greek economy was heading for bankruptcy years ago. And we won’t do bankers, insurers and underwriters the injustice of claiming they were so incompetent they didn’t see it coming.

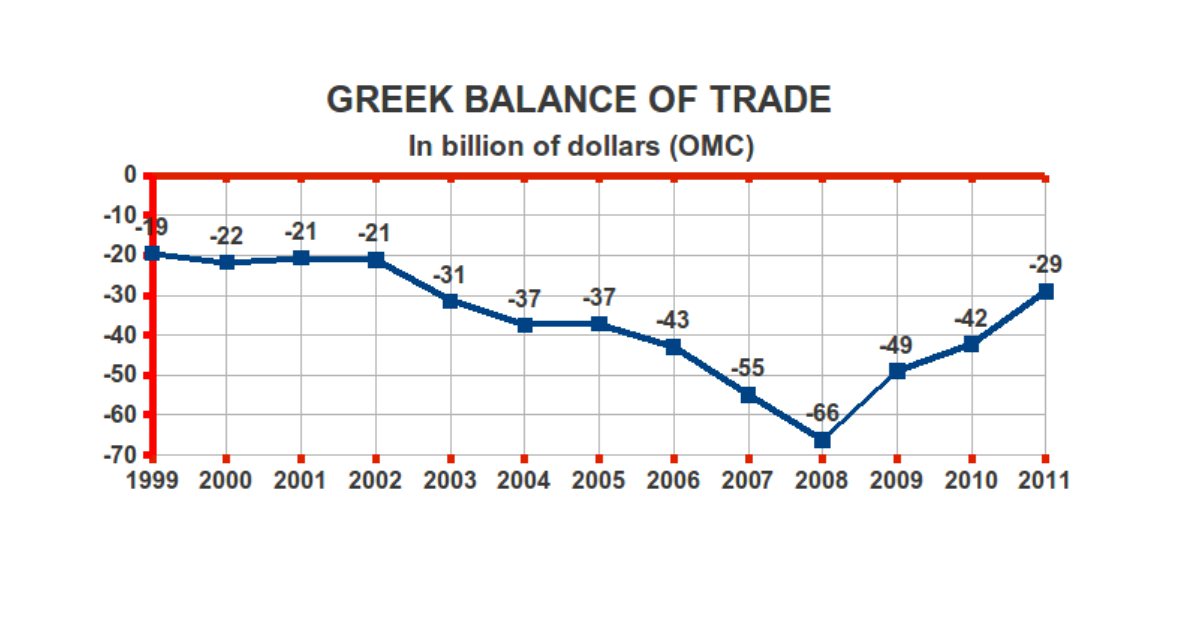

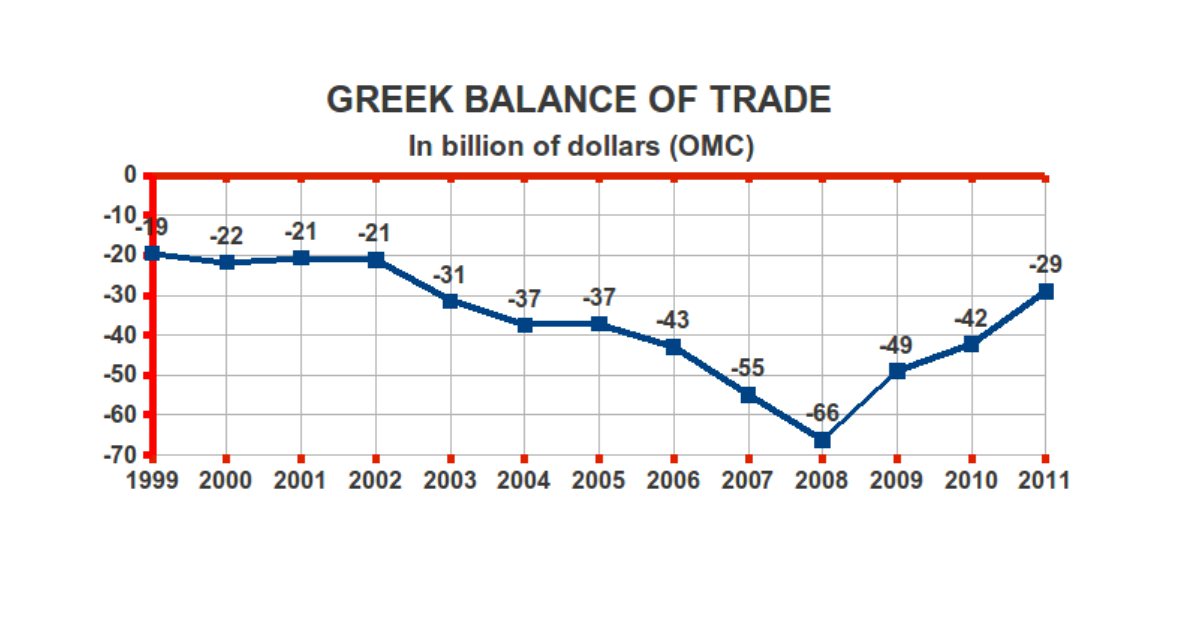

Greece balance of trade was constantly in deficit and had been getting steadily worse for years, passing from -19 billion dollars in 1999 to -66 billion in 2008. After that it reduced gradually, due to the country’s dramatic recession.

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| Billions |

|

|

-9,82 |

|

|

|

|

|

|

|

| As % of GDP |

|

|

|

|

|

|

|

|

|

|

This trade deficit wasn’t offset by incoming capital or earnings from tourism. On the contrary the deficit in the balance of payments took a more and more catastrophic turn. From around 10 billion dollars in 2000, the deficit in the balance of payments has been continuously rising, hitting 51 billion in 2008. In relation to the Gross Domestic Product this corresponds to -7.73% in 2000 and -15% in 2008!

But the GDP, which is far from being a reliable measure of a country’s prosperity and economic development, then went up by an average annual rate of 4.2%, better than many other countries in Western Europe or in North America. In the resulting euphoric atmosphere, and due to the craving for profit that so torments the bourgeoisie, everybody was suddenly eager to lend to Greece, and not just to the State but to private companies as well. The bourgeoisie either couldn’t or refused to believe that a new crisis of over-production was on its way.

But at the end of 2008, as regular as clockwork, the crisis hit anyway. The alarm bells went off and the various States tried to bail out the financial system and support private enterprise, notably by investing in major infrastructure projects. Instead of “Less State – more private initiative” suddenly it was “State capitalism” again, which had never really gone away in any case.

The central banks turned on the credit tap by lowering interest rates, and the various States, already in debt, got even deeper in debt to salvage capitalism and avoid a recession combined with deflation like in 1929. Suddenly Europe, the United States and China were gulping down thousands of billions of dollars to avoid such a eventuality.

States such as Iceland, Ireland and Spain, which up to that point had not been that much in debt, suddenly found themselves on the verge of bankruptcy. Strangled by enormous loans to bail out the banks and to stimulate the economy, and by a steep drop in tax revenue due to the depth of the recession, they found themselves either actually or on the verge of bankruptcy.

Greece was already deeply in debt both in the public and private sector. What is more, the “rescue” of the Greek banks by the European Central Bank consisted in the latter taking the former’s best securities in exchange for ready cash. This operation brought about the situation in which the Greek banks find themselves today, with an enormous quantity of bonds of highly dubious value and a debt of around 106 billion euros to the ECB, a debt which they will never be able to repay.

That is what caused the explosion.

The Origin of the Crisis

Based on Eurostat data, we have plotted curves representing the level of public debt in the countries just mentioned as percentages of their Gross Domestic Product. Before the crisis Iceland, Ireland, Spain and Portugal all had low levels of indebtedness, less than 40%. Indeed Spain and Ireland had actually been engaged for many years in a process of debt reduction. Only Italy and Greece stood out from the crowd with a level of debt which was already high before the crisis at the end of 2008: 107% for Greece and 103% for Italy.

It can be seen that the curves bend sharply upwards at the beginning of the crisis. Only Italy – which had been engaged in a process of reducing its budget deficit since 2000 – would manage to avoid losing control of its debt, but at the cost of stagnation and a steep drop in industrial production during the crisis. In fact Italy was already in recession by the start of the new century: in 2011 it registered a -18.2% compared to the figure for 2000.

The essential point to understand is that the financial crisis in

Greece

and other countries like Argentina, Iceland, Ireland, Portugal, Spain

and

Italy, is the product of capitalism’s global crisis; a crisis

which didn’t originate in the sphere of circulation (specifically, in

the financial sector, as the bourgeois economists believe) but in the

realm of production: the origin of the crisis lies at the heart of

capitalist accumulation, where value is produced, that is, in

industrial

and agricultural production where the latter is conducted as a

capitalist enterprise !

The source of the crisis lies in the tendency of the rate of

profit

to fall, which translates into a decline in the rate of

accumulation

of the capital which is utilized in the production of commodities. This

is what clearly emerges from the table below.

|

Average annual growth in industrial production |

||

|

|

|

|

| United Kingdom |

|

|

| USA |

|

|

| Francie |

|

|

| Germany |

|

|

| Italy |

|

|

| Russian Federation |

|

|

| Japan |

|

|

| Cina |

|

|

| South Corea |

|

|

Normally a cycle of accumulation is circumscribed by two peaks, followed by a recession and then a revival, with the subsequent peak higher than the previous one. In the following table we have chosen as the starting year the first year after the Second World War in which the pre-war peak was surpassed. This wasn’t the same in every country. In some it was 1950, in others 1951 or 1953. The same goes for 1973, with some countries such as France and Italy reaching their peak in 1974. To simplify the table we have treated the years of departure and arrival as the same for all countries, but as far as any calculations are concerned, the correct years are as stated.

The countries are ranked according to how old their capitalisms are. The exception is the United States, which should have been placed after Germany but has been moved up the list to reflect the massive destructiveness of the Second World War, which “rejuvenated” the organic composition of Capital in German and France.

As can be seen, the younger the capital, the higher the rate of growth, and thus the increase in the accumulation of capital. Over time the rate of growth slows down and tends towards zero. The two periods, which exhibit very different increments, correspond to two phases of capitalist accumulation.

The first period, 1950-1973, is the one which followed the massive destruction of the Second World War; destruction which permitted world capitalism to overcome the depressions of 1929 and 1938 and initiate a new cycle of accumulation. This phase of accumulation, characterised by local crises of overproduction of low intensity and short duration, and mainly concentrated in the United States and Great Britain, was ended by the 1974-5 crisis.

From 1973 a period begins which is characterised by short periods (of around 7 to 10 years) of sluggish accumulation alternating with longer and deeper international crises of over production.

This sluggish accumulation of capital, followed by recessions, means the tax yield is no longer sufficient. This situation is further aggravated by measures adopted by the bourgeoisie in the realm of political economy. Indeed, in order to try and counterbalance the fall in the rate of profit and to get the bourgeoisie to invest , the States are actually reducing taxation on the big companies, imposing less taxes on capital, reducing the direct taxes on the big bourgeoisie and favouring them with various additional tax loopholes.

All of this, in conjunction with the crises of over-production, has produced a situation in which all States have been in debt since 1973, up to the astronomic levels they have reached today. At the same time these national debts contracted by the various States had absorbed a not inconsiderable part of overproduction. Indeed if it had been any otherwise capitalism would have already experienced another 1929 during this period.

But the State isn’t alone in getting into debt because of the crisis. Business is getting into debt, financial institutions are getting into debt, families are getting into debt, and often private debt is much, much higher than public debt.

The series of curves in the graph below show levels of debt in the United States. They were drawn up using Fed data.

The indebtedness of financial institutions isn’t shown. We have

added

an additional table showing the debt of the various countries as a

percentage

of their GDP for the year 2010. This table is drawn up using data from

The

Economist. We can see that countries most in debt that are not the

ones most talked about. Japan’s total debt in 2010 was equivalent to

471% of its GDP! England’s was 466%, Spain’s 366%, etc, etc.

|

% of GDP (The Economist) |

|||||

|

ment |

nancial Business |

holds |

cial |

|

|

| JAPAN | 191% | 90% | 85% | 105% | 471% |

| UK | 66% | 100% | 100% | 200% | 466% |

| SPAIN | 57% | 144% | 85% | 80% | 366% |

| KOREA | 22% | 120% | 70% | 110% | 332% |

| FRANCE | 82% | 110% | 40% | 90% | 322% |

| ITALY | 110% | 80% | 45% | 80% | 315% |

| SWITZERLAND | 34% | 80% | 110% | 90% | 314% |

| USA | 66% | 80% | 100% | 50% | 296% |

| GERMANY | 71% | 70% | 65% | 65% | 286% |

| GREECE | 145% | 63% | 63% | 270% | |

| CANADA | 64% | 55% | 90% | 50% | 259% |

| CHINA | 33% | 98% | 7% | 20% | 158% |

| BRAZIL | 67% | 27% | 28% | 20% | 142% |

| INDIA | 67% | 38% | 14% | 10% | 129% |

| RUSSIA | 4% | 40% | 9% | 18% | 71% |

In Greece, same as elsewhere, the State, businesses, families and the financial institutions are all in debt. We don’t have a detailed breakdown of this debt as there is a lack of data about the financial institutions. We only have the total debt of non financial businesses and of families, which we have split in two equal parts although they are certainly different. However, we can see easily enough that Greece isn’t the country with the highest debt.

What differentiates nations like Greece, Iceland, Ireland and Spain from countries like Japan, the United Kingdom and France is that the latter are great imperialist States, even if they are in decline and not as powerful as they used to be.

Nevertheless, we can see straightaway that the situation in Spain,

given

its importance on the economic and international level, is serious: a

debt

equivalent to 366% of their GDP!

Who Actually Pays Taxes?

In order to explain the bankruptcy of the Greek State, many commentators have accused “the Greeks” of living beyond their means and of “not paying their taxes”. The president of the International Monetary Fund, Christine Lagarde, has urged “the Greeks” to pay their taxes. Of course as far as journalists and the bourgeoisie are concerned classes don’t even exist. They lump together the worker and the bourgeois despite the fact that the latter lives off the former, possesses the means of production and appropriates for itself the product of labour. The anti-Americans reason in the same way. They make no distinction between the big industrial and financial bourgeoisie which controls America’s political economy and the worker who slaves away for his wage and has no influence at all, either on political economy or on “his” country’s diplomacy.

According to the head of the tax inspectorate under the Papandreu government, Nicolas Lekkas, interviewed by Les Échos on 21/11/2011, tax evasion in Greece has gone up to around 40 to 50 billion euros per annum. This figure seems highly exaggerated when compared to the GDP of 230 billion. Other sources give a figure of between 10 and 15 billion per annum, still a staggering figure for such a small country.

In order to fight tax evasion the Greek government is negotiating a

tax agreement with Switzerland based on ones already in place with

Germany

and Great Britain. In the agreement the Federations’s banking secrecy

will be preserved in exchange for the collection by the Greek tax

authorities

of tax on capital deposited in Switzerland. Nicolas Lekkas declared,

using

data from the Central Bank, “no-one pays taxes in Greece; we have

drawn up an initial list of 720 actual people who have sent more than a

million euros abroad, and some of them up to 150 million euros”.

So who isn’t paying their taxes? In all the Western countries

wage-earners

certainly do. Not only do they not have millions to deposit in the

Swiss

banks, but the tax authorities are told exactly what they are earning

by

their employers (for instance, the PAYE system in England). It is the

bourgeois

who don’t pay their taxes: the industrial, financial and landowning

bourgeoisie,

the self-employed, etc, etc. For instance, according to the tax

declarations

of the doctors of the Kolonaki district, the wealthiest in Athens, they

earn around the minimum wage! “In 2008 – writes Niels Kadritzke in

the March 2010 issue of La Monde Diplomatique –

members of the

professions (doctors, lawyers, architects) declared an annual income of

10,493 euros, businessmen and financial traders declared on average

13,236

euros, whilst the average annual income of employees and pensioners was

16, 123 euros. As far as the tax man is concerned, the workers,

employees

and pensioners are the wealthy ones”.

So are there any countries where the bourgeoisie pays its taxes? In France, like every other country after the 1974-75 crisis, and accelerating after 2000, every successive government has continued to lower direct taxes on the higher incomes: from around 60% on the highest tax band down to 41%. To this has been added numerous tax loopholes, which take the rate of taxation on the big bourgeoisie down to a lot less than 41%. In the United States, which was one of the most egalitarian States along with Great Britain between 1945 and 1975, the highest tax bracket, which was 70% up until 1981, has now been lowered to 30%. And this abundant generosity hasn’t prevented yet more tax evasion, often with the complicity of the administration, which knows all about ‘looking the other way’. Thus tax evasion in the United States is said to be around 330 billion dollars a year, 97 Billion pounds in England, and 40 to 50 billion euros in France! Naturally in Italy as well those who pay the taxes are mainly workers, employees and pensioners. In 2010 they were responsible for 82% of the entire tax yield whilst self-employed workers, entrepreneurs, traders, landowners, etc, paid in a derisory 18%!

And the tax cuts and allowances don’t stop there. The monopolies formed by the big companies like Danone, Carrefour, Total, BP, Shell and so on, pay very little income tax and even less VAT. To them is offered a whole range of possibilities for paying less, ranging from the abundant tax havens up to the fiscal paradises controlled by four big international banks who are well established in all the big cities.

«If the tax on corporations is officially 33.3 %, the reality is quite different. According to a study by the treasury board, the average rate – calculated from the net operating surplus – is 27.5 % for companies as a whole. But take into account the size of the company and everything changes: the rate of corporation taxation on small companies rises to 39.5 %, while for the major companies it falls to 18.6 %. But this is still only an average, and the differences get even bigger once one tackles the last decile, the CAC (-40). Same as it is with the very wealthy, the French tax system seems to be very accommodating with regard to the CAC (-40), allowing it to adjust at its leisure the exemption rules and affording it every opportunity to avoid paying the tax.Therefore Greece isn’t the only country where the bourgeoisie doesn’t pay its taxes and where tax evasion takes place with the complicity of the State – the latter of course being merely the representative of the bourgeoisie’s interests – and the tragic situation Greece finds itself in cannot be summed up as a tax question. In all the major countries, the State, financial and non-financial businesses, and families are all deep in debt. And it is a process that has got worse and worse since the 1974-75 crisis with the debt reaching truly mind-boggling proportions today. The level of indebtedness of the British banks, for example, is already 200% of the GDP!

«According to the report of the Finance Committee, the companies of the CAC (-40) have paid 13.5 billion euros of the corporation tax accumulated between 2007 and 2009. After deductions of benefits derived from various tax credits (postponement of previous deficits, employment support, etc), the balance drops to 10 billion euros over the three years. This figure is similar to that of earnings announcements. Over the same period, the companies of the CAC (-40) realized more than 230 billion euro in cumulative benefits» (Mediapart, 6 July 2010).

There

are

only two ways to solve this problem: the cancellation of all debt –

which

presupposes the communist Revolution – or a third world war.

The Liabilities of the Banks

In 2009 the Greek government announced a budget deficit of 6% of GDP. Considering that the French deficit over the same period was 7.5%, Greece seemed to be on a similar footing with other countries. However, as we later learnt from an article in the New York Times , Goldman Sachs, the Greek government’s consultant until 2009, had been helping to “cook the books”; indeed it was the practice of this bank to encourage its clients to bet on risky ‘securities’ in order to profit from their losses later on. When Papandreu became head of government in October 2009, he decided, faced with the enormity of the situation, to make the accounts public and ask Europe for help: the trade deficit now stood revealed as 12.7% of the GDP, with a debt was 298 billion euros, 112.5% of GDP!

The rest of the story is well known. Rates of interests shot up, reaching 7% on ten year loans and making any further borrowing on the financial market impossible. After much humming and hawing and rising tension between the German and the French governments, with the latter even threatening to leave the Eurozone if nothing was done, eventually intervention was seen as the only option, for if Greece was forced to freeze its payments, a veritable financial tsunami would be the result.

So what was the situation at that time? We have seen Greece had a

budget

deficit of 12.7% of its GDP and a private debt and public debt of

around

284 billions and 300 billion euros. How exposed were the banks to

Greece?

We don’t have data for 2009, but the 10/5/11 issue of the French

economic

journal

Les Echos gives us the following figures, in billions of

dollars, for the 3rd quarter of 2010:

|

|

|

|

|

|

|

|

|

|

|

|

As to how reliable the information provided by the banks actually is, here is what a Mediapart journalist writes in their 16/6/11 number, reporting on declarations by the BNP and the Societé Generale on the extent of their financial involvement in the Greek State:

«These figures don’t seem to correlate with the risks highlighted by Moody. They absolutely don’t correspond to the statistics published by the Bank of International Settlements, which estimates the French bank’s exposure as 15 billion euros. Are we supposed to deduce that 7 billion dollars of Government bonds are held by the minor banks? Unless the bonds have been removed from the banks’ balance sheets along with life assurance policies and other ‘safe’ financial products sold to their clients? Everywhere we find this opacity about how indebted the banks actually are, and that includes the ECB. According to some, the Greek risk for the Central European Bank amounts to 45 Billion euros. The Wall Street Journal estimates it to be 120 Billion. Who to believe? This situation translates into something very real. Despite the crisis, despite all the promises of further regulation and control, the European banking system remains a “Chinese box”. No-one, including the ECB, really seems to know what is inside it».In fact the banking system and the financial system in general has always been a “Chinese box” and it will remain so whatever the politicians promise. In any case, sticking with these figures and a few others provided by the press, it emerges that in mid 2011 the European banks supposedly held 162 Billion euros of Greek debt, including 52 billion in Government bonds; 85% of this debt is held by the French and German banks, a percentage which drops to 70% if Greek debt to all banks is taken into consideration, including those in the United States.

As we can see, the French banks were more deeply committed than the German ones and maybe more than these figures show. We can therefore understand Sarkozy’s nervousness. It should be noted that a few of the French banks, and it is surely the same for the German banks as well, control some Greek banks and therefore hold, albeit indirectly, a portion of the 50 billion worth of Greek Government bonds held by the banks in Greece.

In the end, compelled by events, Frau Merkel gave in, and agreed to a 110 Billion euro support package. But there are conditions and “the Greeks” will have to pay (the millionaire and the worker; the millionaire funding a few few soup kitchens and the workers with blood, sweat and tears, to pay off the debt and save the millionaire), about that all are agreed, the ECB and the French government. Indeed the latter has already turned a profit from its loans to Greece, as have the other governments. The French government lent 9 billion euros in 2011, which has brought in around 300 million euros, and the interest in the first quarter of 2012 has already brought in 69 million into the State coffers.

The measures imposed on the Greek State can be divided into three parts.

Two opposing positions on how to tackle it arose: the German government opted for a ‘restructuring’ of the Greek debt, that is to say, a reduction in the value of the bonds held by the banks, with these devalued bonds exchanged for other long term ones. The ECB, supported by the French government would strongly oppose this. Tucked away in its vaults the ECB has 47 billion worth of Greek bonds which it bought to alleviate the suffering of the banks. This acquisition of bonds on the secondary market – that is, the market where the various financial institutions resell titlespreviously purchased from borrowers – has been presented relief aid for the States in difficulty. Despite 47 billions worth of bonds being no small amount – acquired for 40 however – it is not the main reason for the ECB’s rigid opposition to any devaluation. What both the directors of the ECB and the French government fear is that a partial failure of the Greek State could prompt a crisis in countries like Italy and Spain, causing the rates of interest to rise and making it more and more difficult for these States to access the capital markets, with the knock on effect of part of the European banking system failing, bringing down with it the French and German banks with heavy loan commitments in these countries.

Here is what Martin Feldstein, Reagan’s ex counsellor on the economy and professor of economics at Harvard, had to say on the matter in Les Échos of 3/10/11, an article which we cite almost in its entirety, both because it is interesting and because it confirms our vision:

«Faced with an apparently irresolvable situation, Greece only has one way out: declaring itself bankrupt. And by following this path, it should be able to devalue the most entrenched part of its debt by at least 50%. The current plan of reducing the value of the bonds held by the private sector by 20% is only one of the first steps towards this result.Instead of confronting the problem, therefore, the European bourgeoisie is trying to buy time, hoping to reinforce and disengage their own banks in order to render them capable of dealing with Greece’s bankruptcy, and above all to prevent the contagion from spreading to Spain and Italy. And in so doing, they have probably aggravated the situation.

«By exiting from the euro, Greece could put a devalued currency back in circulation, stimulating demand and thus achieving a positive balance of trade.The markets know perfectly well that Greece, already insolvent, will go bankrupt sooner or later. Why are France and Germany trying to prevent or, more precisely, delay the inevitable? There are two obvious explanations.

«Firstly, the banks and other financial institutions in Germany and France are highly exposed to the Greek public debt, both directly and through loans to banks in Greece and the Eurozone. By postponing the date of the default, the financial institutions in Germany and France are buying time to reinforce their capital base, to reduce their involvement with the Greek banks and hand over their Greek bonds to the European Central Bank.

«The risk of the bankruptcy of the Greek State spreading its contagion to other States and destabilising their banking systems, in particular in Spain and Italy, is the second, even more important, reason why the French-German alliance is trying to postpone the event. A crisis in one of these major economies would have disastrous consequences for the banks and the other financial institutions in France and Germany. If Greece can avoid bankruptcy, the European political leaders can then show that the situation in Italy and Spain is salvageable.

«But if in the weeks to come nothing is done to prevent Greece declaring itself bankrupt, the financial markets will certainly see bankruptcy in Italy and Spain as more likely. The rates of interest these States would then have to pay on the market would go sky high and their national debts would mount rapidly, rendering them effectively insolvent. By postponing Greece’s bankruptcy for a couple of years, the European political leaders hope to give Spain and Italy time to demonstrate the viability of their financial situation».

(To be continued)